The Finance Act 2023 has added subsection (20) to section 155, which came into effect on 1st October 2023. This provision applies in cases where income is declared in the income tax return for a particular assessment year, but the corresponding Tax Deducted at Source (TDS) is deducted in a subsequent financial year. To give effect to this change, the Central Board of Direct Taxes (CBDT) issued Notification No. 73/2023 on 30th August 2023, introducing Rule 134 under the Income-tax Rules, 1962. As per this rule, taxpayers are required to submit Form 71 to claim the TDS credit in such cases.

Extract of Section 155 (20)

Where any income has been included in the return of income furnished by an assessee under section 139 for any assessment year (herein referred to as the relevant assessment year) and tax on such income has been deducted at source and paid to the credit of the Central Government in accordance with the provisions of Chapter XVII-B in a subsequent financial year, the Assessing Officer shall, on an application made by the assessee in such form, as may be prescribed, within a period of two years from the end of the financial year in which such tax was deducted at source, amend the order of assessment or any intimation allowing credit of such tax deducted at source in the relevant assessment year, and the provisions of section 154 shall, so far as may be, apply thereto and the period of four years specified in sub-section (7) of that section shall be reckoned from the end of the financial year in which such tax has been deducted:

Provided that the credit of such tax deducted at source shall not be allowed in any other assessment year.

Rule 134 under the Income-tax Rules, 1962

(1) The application required to be made by the assessee under sub-section (20) of section 155 shall be in Form No. 71.

(2) Form No. 71 shall be furnished to the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) or the person authorised by the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems).

(3) Form No. 71, shall be furnished electronically, —

- under digital signature, if the return of income is required to be furnished under digital signature;

- through electronic verification code in a case not covered under clause (i).

(4) The Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems), as the case may be, shall specify the procedures for furnishing Form No. 71 and shall also be responsible for formulating and evolving appropriate security, archival and retrieval policies in relation to the form so furnished.

(5) The Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems), as the case may be, or any person authorised by the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) shall forward Form No. 71 to the Assessing Officer.

Purpose of Filing Form 71

- Form 71 allows tax payer to correct TDS credit mismatches caused by tax deducted in the wrong FY.

- Taxpayers now have the opportunity to claim credit for wrongly deducted tax, even if they missed the deadline to file a revised ITR.

Let’s consider an example to better grasp the concept. Suppose an individual has Rs 10 lakh Professional Income in FY 2022–2023 (AY 2023–2024), and the Diductor withholds TDS. However, in FY 2023–24 (AY 2024–25), the diductor incorrectly withholds tax on the Professional Fees. In this case, the individual will not be eligible to receive credit for this TDS in FY 2023–24 (AY 2024–25) since the tax was withheld in the wrong financial year. The TDS credit for this income can only be claimed for FY 2022–2023, as the Professional Income was taxable in that fiscal year.

How to file Form 71

- Login to the Income Tax Portal

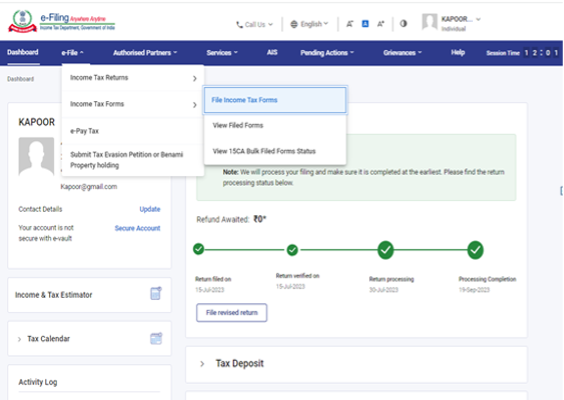

- Go to E File >> Income Tax Forms >> File Income Tax Forms

- Go to “Persons not dependent on any source of income” tab and Click on File now on “Procedure for Assessment” (Form 71)

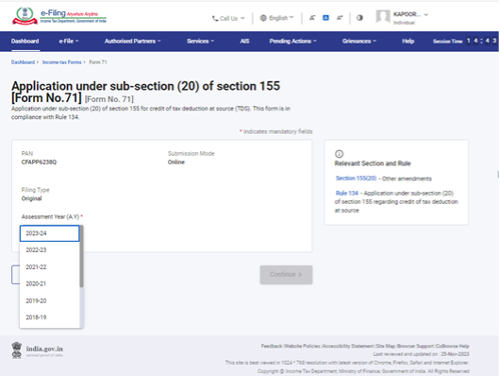

- Select the Relevant Assessment year for which Form 71 is being filed

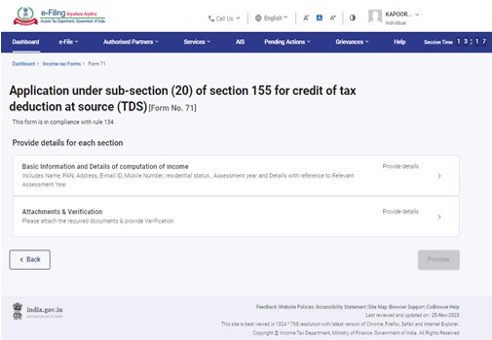

- Click on Lets get started and there will be 2 tabs called “Basic Information and Details of Computation of Income” and Attachments and verification

- Click on Basic Information and Details of Computation of Income and enter the details required.

- Upload the supporting documents and click on Save.

- Do the E Verification through Aadhaar OTP or Bank EVC or Net Banking

Conclusion

Form 71 marks a significant step forward in tax administration, providing taxpayers with a streamlined process to address discrepancies related to TDS credit, particularly when the income is reported in a prior year’s return but the TDS is deducted in a subsequent year. This facility allows individuals to rectify such mismatches efficiently, ensuring that they receive the correct TDS credit to which they are entitled. By introducing a clear and direct method for making these corrections, the initiative not only simplifies the process for taxpayers but also contributes to a more accurate and fair taxation system.

Disclaimer: The content/information is only for general information of the user and shall not be construed as legal advice. While the we exercised reasonable efforts to ensure the veracity of information/content, we shall be under no liability in any manner whatsoever for incorrect information, if any. Users are advised to seek professional legal counsel for advice specific to their individual circumstances